Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Unlocking Financial Services with Generative AI and Converged Infrastructure

Authors: Ashwin Tambe, Suraj Chaudhary

DOI Link: https://doi.org/10.22214/ijraset.2024.65206

Certificate: View Certificate

Abstract

Generative Artificial Intelligence (Gen AI) is poised to revolutionize financial services by empowering institutions to unlock the true potential of their data, driving a wave of innovation in risk management, personalized customer experiences, improved financial analytics, secure AI model training, and optimized high-frequency trading. Unleashing this potential necessitates a converged infrastructure that integrates cloud and on-premise resources with high-performance computing (HPC).Given Gen AI\'s demanding nature, the immense computational power offered by HPC is critical. This paper explores the crucial role of HPC in supporting Gen AI workloads within financial services, along with considerations for converged infrastructure, potential challenges, and a roadmap for successful Gen AI implementation.

Introduction

II. INTRODUCTION

Generative AI (Gen AI) is transforming financial services with its ability to analyze vast amounts of data and create new financial outputs. From fraud detection to personalized investment advice, Gen AI unlocks a wealth of benefits across several key areas.

Gen AI empowers institutions to proactively manage risk by sifting through data in real-time to identify suspicious activity. It also personalizes the banking experience by tailoring financial products and recommendations to individual customers. Furthermore, Gen AI can enhance financial analytics through simulations that prepare institutions for future market conditions. Additionally, Gen AI can create synthetic data,[4] anonymized data critical for training AI models while safeguarding sensitive customer information. In the fast-paced world of high-frequency trading (HFT), Gen AI can optimize trading strategies at lightning speed. Finally, Gen AI streamlines regulatory compliance by automating complex financial reports. However, unlocking Gen AI's potential requires significant computing power. High-Performance Computing (HPC) offers a solution, but it comes with challenges. A converged infrastructure approach that combines on-premise and cloud resources can address these challenges and unlock the full potential of Gen AI in finance.

II. USE OF GENERATIVE AI IN FINANCIAL SERVICES INDUSTRY

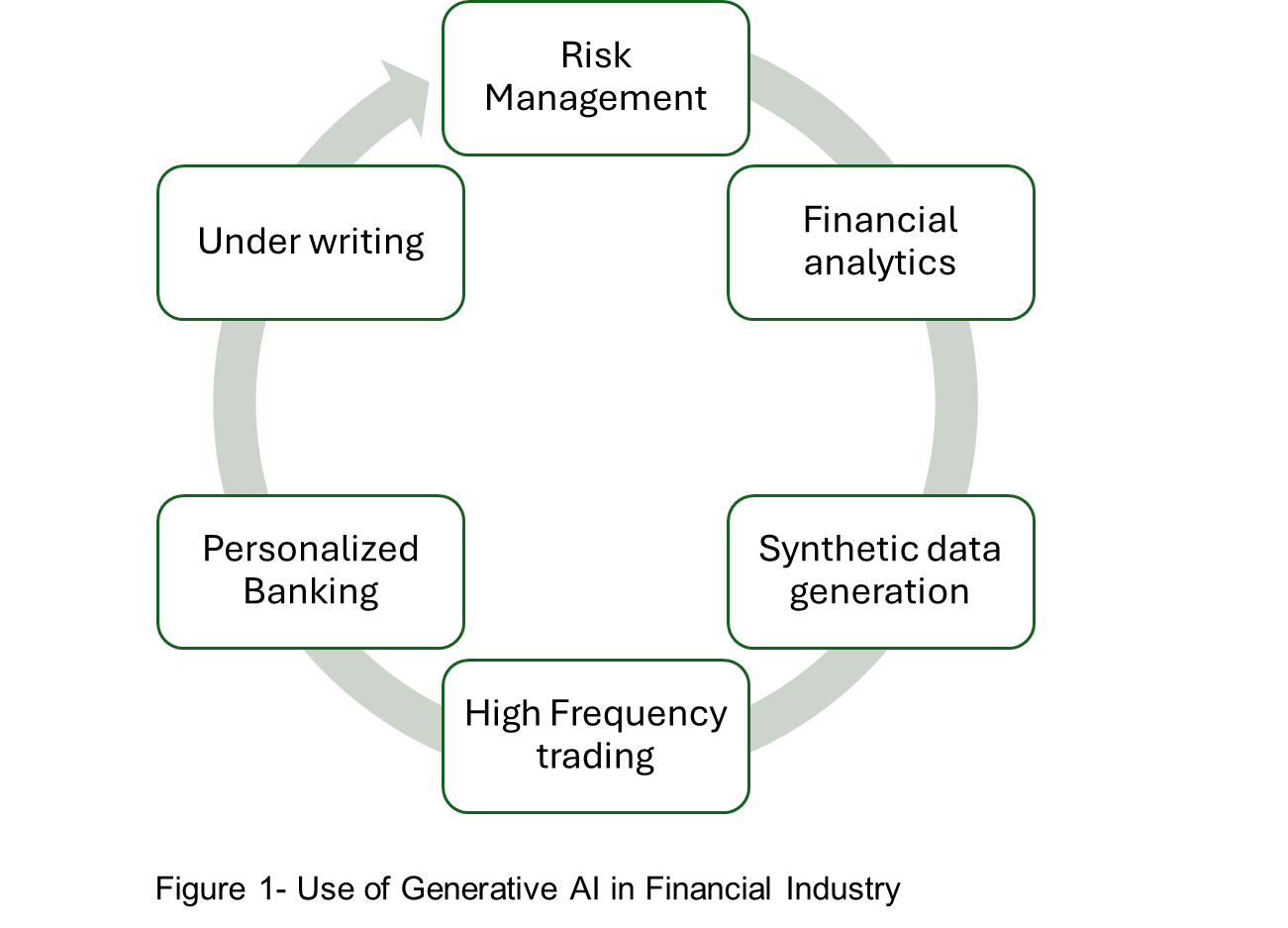

The financial services industry is on the cusp of a revolution driven by Generative AI (Gen AI). This powerful AI technique leverages machine learning to create entirely new outputs, from financial reports to personalized investment strategies. At its core are large, complex computer programs trained on massive datasets of text and code. These programs can generate human-quality text, translate languages, and write different kinds of creative content. Specialized versions of these programs are further trained on financial data, making them ideal for tackling industry-specific challenges. Financial institutions are data-rich environments, generating vast amounts of complex data on transactions, markets, and customer behavior. Gen AI unlocks the true potential of this data by extracting valuable insights and automating tasks that were previously manual and time-consuming. By training and fine-tuning these programs on this data, financial institutions can unlock a wealth of benefits across several key areas See figure 1.

First, Gen AI can revolutionize Risk Management and Fraud Detection.[1] By sifting through massive datasets in real-time, Gen AI can identify anomalies and uncover hidden patterns that might indicate fraudulent activity. This proactive approach allows institutions to catch fraudulent transactions before they occur, leading to significant cost savings and protecting them from financial losses. For example, Gen AI can analyze transaction patterns to identify unusual spending habits that could signal a compromised account.

Second, Gen AI can personalize the banking experience. By analyzing customer data, including financial holdings, spending habits, and risk tolerance,[2] Gen AI can tailor financial products and recommendations to individual needs. This personalized approach goes beyond basic product suggestions and fosters deeper customer relationships by providing relevant financial guidance. For instance, Gen AI can recommend investment options that align with a customer's risk tolerance and financial goals.

Third, Gen AI can enhance financial analytics. It can power sophisticated simulations, enabling real-time stress testing of financial models and preparation for future market conditions. This foresight empowers institutions to make informed decisions about investments, risk management, and resource allocation, mitigating potential risks before they become problematic. Imagine Gen AI simulating the impact of various economic factors on a portfolio, allowing institutions to proactively adjust their strategies.

Fourth, Gen AI can create Synthetic Data. This is anonymized and realistic data, a valuable tool for training AI models and testing scenarios while ensuring data privacy and compliance with regulations. This is particularly important in the financial services industry, where customer data security is paramount. For example, Gen AI can generate synthetic customer profiles that preserve data privacy but contain all the necessary details for testing new loan approval algorithms.

Fifth, Gen AI has the potential to improve High-Frequency Trading (HFT).[9] By analyzing historical data and market trends, Gen AI can develop and optimize trading strategies at speeds exceeding human capabilities. This can potentially increase success probabilities in the fast-paced world of HFT, where milliseconds can make the difference between a profitable trade and a loss. Gen AI can analyze market movements in real-time and identify trading opportunities that might be missed by traditional methods.

Finally, Generative AI can streamline Regulatory Compliance.[3] It can automate the generation of complex financial reports, ensuring ongoing monitoring and adherence to regulations. This frees up valuable human resources from tedious tasks and allows them to focus on more strategic initiatives. By automating compliance processes, Gen AI can save institutions significant time and money.

III. CASE STUDY- PAYPAL

A. Challenge

In the ever-evolving world of online payments, PayPal,[5] a global leader, grappled with increasingly sophisticated fraud schemes. Protecting its vast customer base and maintaining financial stability necessitated a robust upgrade to its fraud detection system.

B. Objectives: There were two fold objectives

Significantly reduce financial losses incurred due to fraudulent activities and adapt rapidly to emerging fraud patterns.

Maintain Customer Trust by ensuring the security and privacy of customer data while fostering a positive user experience through minimized fraudulent activity.

Why Traditional Methods Fell Short: Traditional fraud detection methods, relying on static rules and historical data analysis, struggled to keep pace with the dynamic and innovative tactics employed by fraudsters. The sheer volume of transaction data also posed a significant challenge, hindering real-time analysis and timely intervention.

The HPC Solution: PayPal embraced the power of High-Performance Computing (HPC) to overcome these limitations.HPC provided the critical infrastructure for:

Real-Time Analysis: Processing massive datasets containing real-time transaction data at exceptional speed, enabling immediate identification of suspicious activity.

Advanced Model Training: Training complex Gen AI and ML algorithms on vast datasets to recognize intricate patterns indicative of fraud, even in novel schemes.

Scalability: Seamlessly scaling resources to accommodate the ever-growing volume of transaction data, ensuring consistent performance even as transaction volumes increase.

C. Generative AI and Machine Learning: The Dynamic Defense

HPC empowered PayPal to leverage cutting-edge Gen AI and ML technologies. These intelligent algorithms were trained on historical data to identify anomalies and suspicious patterns.

Generative AI: This technology [6] helped generate synthetic data sets, simulating potential fraudulent transactions. This allowed the ML models to train against a wider range of scenarios, enhancing their ability to detect even the most obscure fraudulent activities.

Machine Learning: Continuously adapting ML algorithms automatically learned from new data and evolving fraud tactics. This dynamic learning process ensured the system remained effective against emerging threats.

D. Results: A Triumph of Technology and Security

By integrating HPC, Gen AI, and ML, PayPal achieved remarkable results:

Reduced Fraud Losses: Between 2019 and 2022, PayPal witnessed a near 50% decrease in fraud-related losses, a testament to the effectiveness of the AI-powered system.

Enhanced Customer Protection: The dynamic adaptability of AI models led to swifter detection and prevention of fraudulent transactions, safeguarding customer accounts and promoting trust.

Scalability for Growth: The HPC infrastructure ensured the system could effectively manage the significant increase in transaction volume, which nearly doubled from $712 billion to $1.36 trillion during the same period.

PayPal's strategic adoption of HPC, Gen AI, and ML stands as a compelling case study in the financial services industry. This powerful combination provides a robust defense against fraud, ensuring financial security and fostering customer trust. As the volume and complexity of financial transactions continue to grow, HPC will undoubtedly play a pivotal role in safeguarding financial institutions and their customers.

IV. NEED FOR HIGH PERFORMANCE COMPUTING

The financial sector thrives on information. Every transaction, every market fluctuation, every economic whisper generates data, and mountains of it. This data holds the key to unlocking valuable insights, optimizing strategies, and ultimately, achieving financial success. However, traditional computing infrastructure often struggles to keep pace with the sheer volume and complexity of this data. This is where High-Performance Computing (HPC) steps in, acting as a powerful engine for a new breed of financial solutions – generative AI.

Generative AI, with its ability to create entirely new and original content, holds immense potential for the financial industry. From crafting personalized investment strategies to generating realistic market simulations, generative AI can revolutionize how financial institutions operate. However, unleashing this potential requires a foundation capable of handling the immense computational demands of these sophisticated AI models. This is where HPC comes to the rescue.

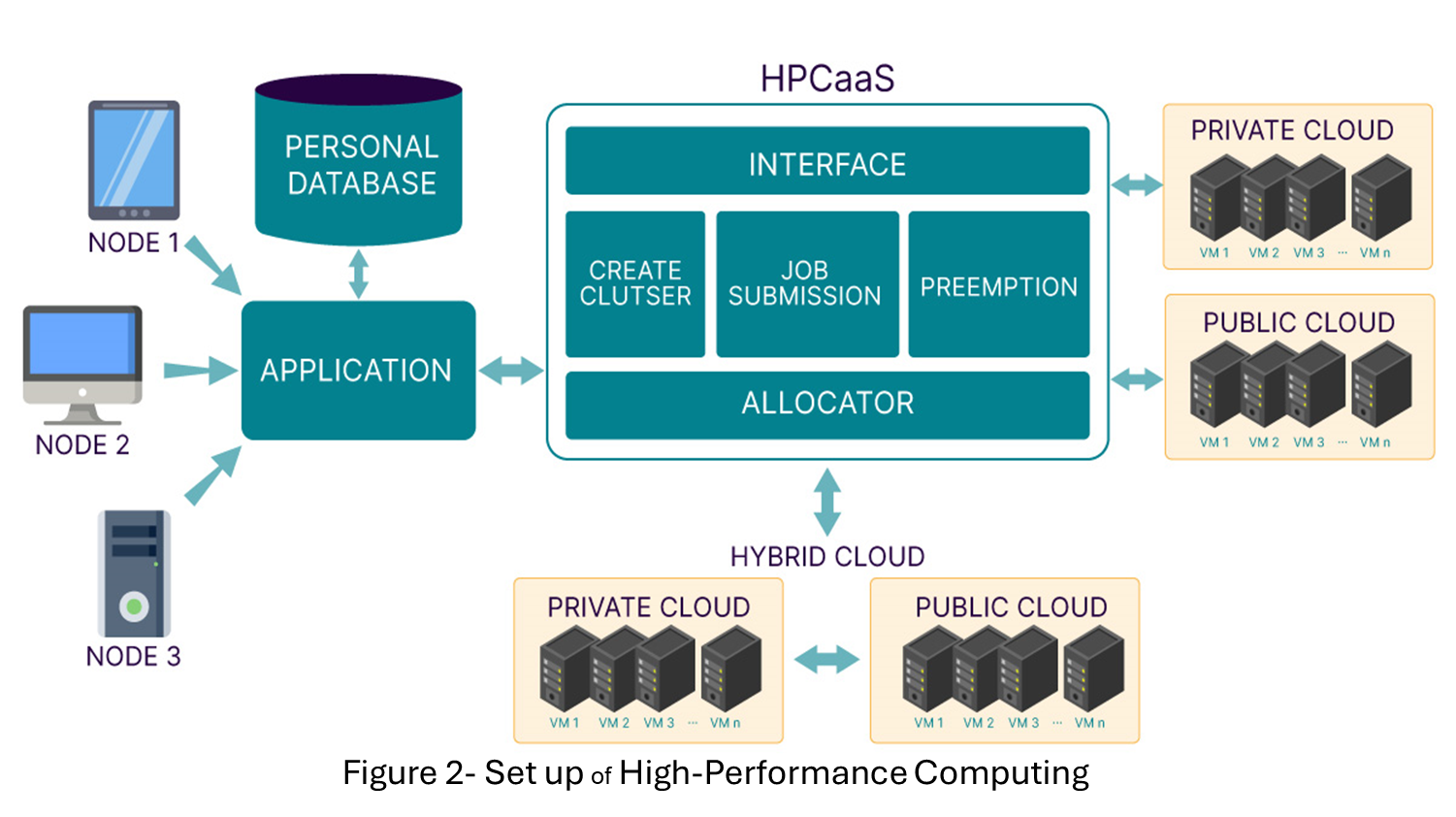

HPC is a powerful network of interconnected computers designed for parallel processing. Imagine a team of mathematicians working together to solve a complex equation. HPC operates in a similar fashion, harnessing the collective processing power of multiple machines to tackle massive datasets and intricate calculations with unparalleled speed and efficiency. See figure 2

V. BENEFITS & CHALLENGES OF HPC

This translates to several key benefits for generative AI in finance:

- Faster Innovation: Training generative AI models can be incredibly time-consuming. HPC[13] accelerates this process significantly, allowing financial institutions to experiment and iterate at a much faster pace. This rapid development cycle fosters innovation and empowers institutions to stay ahead of the curve in a constantly evolving financial landscape.

- Deeper Insights: Generative AI thrives on vast amounts of data. HPC enables the processing of not just large datasets, but also complex, interconnected data points. This allows generative AI models to uncover nuanced relationships and patterns that might be missed by traditional analysis methods. These deeper insights can lead to more informed decision-making, improved risk management, and ultimately, a competitive edge.

- Enhanced Accuracy: Generative AI models are only as good as the data they are trained on. HPC ensures the accuracy of this data by facilitating its meticulous cleaning and pre-processing. This meticulous data preparation leads to more reliable and trustworthy outputs from generative AI models.

- Scalability for Growth: The financial sector is constantly generating new data. HPC infrastructure is designed to scale seamlessly, allowing financial institutions to adapt their computing power to meet their evolving needs. As data volumes increase, so too can the computational muscle of the HPC system.

Despite undeniable advantages, High-Performance Computing (HPC) presents financial institutions with hurdles to overcome. The initial setup and ongoing maintenance of HPC infrastructure requires a significant financial investment.[12] This cost encompasses acquiring top-of-the-line hardware – powerful processors, specialized accelerators like GPUs, and high-speed networking equipment. Additionally, software licenses for HPC systems can be expensive, and ongoing maintenance necessitates a dedicated team to keep the system operational and ensure optimal performance.

Generative models are akin to supercomputers with insatiable appetites for data. The more data[10] they are fed, the better they perform at tasks like generating realistic market simulations, crafting personalized investment strategies, and uncovering hidden patterns in complex financial datasets. This aligns perfectly with the data explosion happening in financial services. Data volumes in the financial industry are expected to skyrocket by several hundred percent in the next few years, with some estimates predicting a staggering 300% to 500% increase within the next five years.[7]This confluence of data-hungry AI and abundant financial data creates a golden opportunity for innovation in finance.

Furthermore, leveraging HPC effectively demands a specialized skillset. Managing the intricate hardware and software is no easy feat. HPC systems are complex beasts, requiring expertise in areas like system administration, parallel programming, and job scheduling. Optimizing workloads for parallel processing on HPC systems adds another layer of complexity. Traditional coding practices may not suffice, and specialized techniques are needed to break down tasks into smaller, independent units that can be executed simultaneously across multiple processors. This expertise might be scarce within financial institutions, potentially requiring them to recruit specialists or outsource HPC management tasks.[8]

Finally, data security remains paramount. Robust security measures and access controls are essential to safeguard sensitive financial information processed and stored within the HPC environment. Financial institutions are entrusted with vast amounts of customer data, and any breach of this data could have catastrophic consequences. Implementing robust security protocols adds to the overall cost and complexity of HPC adoption, but it's a non-negotiable requirement for ensuring compliance with industry regulations and protecting sensitive information.

Traditional computing infrastructure simply cannot keep pace with the processing demands of training these sophisticated generative models.

VI. SOLUTION:INFRASTRUCTURE CONVERGENCE

The key to harnessing the power of Generative AI (GenAI) in finance lies in a well-orchestrated balance between on-premises infrastructure and cloud frameworks. This converged [11] approach brings together the strengths of each. On-premise mainframes act as the dependable workhorses, handling mission-critical tasks and ensuring core functions like data preparation run smoothly. High-performance computing clusters,[14] housed on-premises, provide the muscle for heavy-duty training of complex GenAI models. Meanwhile, the cloud offers adaptability and cost-effectiveness. Financial institutions can leverage the public cloud for tasks requiring bursts of processing power or on-demand scalability, while keeping sensitive data secure within the confines of their on-premises infrastructure. This hybrid approach, potentially incorporating multiple cloud providers, unlocks the full potential of GenAI in finance, fostering innovation, optimizing costs, and ensuring regulatory compliance.A converged infrastructure strategy for Generative AI in finance unlocks a symphony of benefits for financial institutions:

- Effortless Scaling: Mammoth datasets and demanding AI workloads become a breeze to handle. The converged approach allows seamless scaling across the entire infrastructure, eliminating capacity limitations that might hinder progress.

- Cost Optimization: Financial institutions gain control over spending with this strategy. By strategically distributing workloads, they can leverage the cloud's pay-as-you-go model for tasks with fluctuating demands. This ensures high performance without sacrificing financial prudence.

- Innovation Fast Track: Convergence fosters a fertile ground for experimentation. Financial institutions can readily embrace and explore cutting-edge AI technologies like Generative AI. This rapid adoption fuels innovation and propels them to the forefront of the competitive landscape.

- Rock-Solid Resilience: Disruptions are inevitable, but a converged infrastructure ensures they're not debilitating. Diversifying workloads across multiple environments creates a robust and fault-tolerant system, guaranteeing business continuity even during unexpected events.

Conclusion

Generative AI (Gen AI) is poised to revolutionize financial services by enabling institutions to extract maximum value from their data. This groundbreaking technology offers a multitude of advantages across several key areas, including preemptive risk management, individualized customer experiences, improved financial analysis, secure AI model training, and optimized high-frequency trading. However, unlocking this potential necessitates substantial computational power that traditional infrastructure frequently struggles to deliver. High-Performance Computing (HPC) offers a solution, but it presents its own unique challenges. To conquer these obstacles and unlock the full potential of Gen AI, financial institutions can leverage a converged infrastructure approach. This approach strategically combines on-premise resources, such as dependable mainframes for core functions and HPC clusters for heavy-duty AI model training, with the adaptability and cost-effectiveness of the cloud. By distributing workloads across this hybrid environment, financial institutions can achieve effortless scaling, optimize expenditures, and ensure regulatory compliance. Ultimately, a converged infrastructure empowers financial institutions to harness the power of Gen AI and transform data into a strategic weapon, propelling them to the leading edge of the competitive financial landscape.

References

[1] S. Rallapalli, D. Hegde and R. Thatikonda, \"Feature Selection Based Ensemble Support Vector Machine for Financial Fraud Detection in IoT,\" 2023 International Conference on Evolutionary Algorithms and Soft Computing Techniques (EASCT), Bengaluru, India, 2023, pp. 1-7, doi: 10.1109/EASCT59475.2023.10392566. keywords: {Support vector machines;Training;Finance;Machine learning;Feature extraction;Fraud;Classification algorithms;Internet of Things;Bird Mating Optimization Algorithm;Ensemble support vector machine;High dimensionality;Financial fraud Detection}, [2] V. Singhal, K. Khatri and S. Singhal, \"Risk Management by Grid Computing in AWS,\" 2022 International Conference on Machine Learning, Big Data, Cloud and Parallel Computing (COM-IT-CON), Faridabad, India, 2022, pp. 874-878, doi: 10.1109/COM-IT-CON54601.2022.9850818. keywords: {Costs;Web services;Grid computing;Turning;Real-time systems;Servers;Security;Gridcomputing;Risk anagement;High Performance Computing;Financial Services;AWS;Cloud Computing},v3.0. In: The Manager’s Guide to Web Application Security:. Apress, Berkeley, CA. https://doi.org/10.1007/978-1-4842-0148-0_15 [3] T.S Hung Kwok \"Anti money laundering (“AML”) management and the importance of employees\' work attitude,\" 2013 International Conference on Engineering, Management Science and Innovation (ICEMSI), Macao, China, 2013, pp. 1-4, doi: 10.1109/ICEMSI.2013.6913983. [4] Synthetic data for face recognition: Current state and future prospects;Fraunhofer IGD, Fraunhoferstr. 5, Darmstadt 64283, Hessia, Germany:https://doi.org/10.1016/j.imavis.2023.104688 [5] Paypal Editorial Staff,The power of data: How PayPal leverages machine learning to tackle fraud,Dec 22, 2021. [6] Bogdan Sergiienko, “Generative AI for Fraud Detection: A New Era in Financial Safeguarding for Higher Business Outcomes and Lower Chargebacks”, July 10, 2024 [7] Mckinsey Mckinsey December 5, 2023 | ArticleCapturing the full value of generative AI in banking [8] David Reinsel – John Gantz – John Rydning An IDC White Paper – #US44413318, Sponsored by November 2018 (Data refreshed May 2020 Seagate_DataAge_WP_#US44413318 [9] VISALAKSHI PALANIAPPAN1 A Review on High Frequency Trading Forecasting Methods: Opportunity and Challenges for Quantum based Method IEEE Xplore Full-Text PDF: [10] J. L. Manferdelli, N. K. Govindaraju and C. Crall, \"Challenges and Opportunities in Many-Core Computing,\" in Proceedings of the IEEE, vol. 96, no. 5, pp. 808-815, May 2008, doi: 10.1109/JPROC.2008.917730 [11] D. Tilson, K. Lyytinen and C. Sorensen, \"Desperately Seeking the Infrastructure in IS Research: Conceptualization of \"Digital Convergence\" As Co-Evolution of Social and Technical Infrastructures,\" 2010 43rd Hawaii International Conference on System Sciences, Honolulu, HI, USA, 2010, pp. 1-10, doi: 10.1109/HICSS.2010.141. [12] Shalf, J., Dosanjh, S., Morrison, J. (2011). Exascale Computing Technology Challenges. In: Palma, J.M.L.M., Daydé, M., Marques, O., Lopes, J.C. (eds) High Performance Computing for Computational Science – VECPAR 2010. VECPAR 2010. Lecture Notes in Computer Science, vol 6449. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-19328-6_1 [13] Chang Gee-Kung and Cheng Lin- 2016The benefits of convergencePhil. Trans. R. Soc. A.3742014044220140442 https://doi.org/10.1098/rsta.2014.0442 [14] Del Bo, C., Florio, M. & Manzi, G. Regional Infrastructure and Convergence: Growth Implications in a Spatial Framework. Transit Stud Rev 17, 475–493 (2010). https://doi.org/10.1007/s11300-010-0160-4

Copyright

Copyright © 2024 Ashwin Tambe, Suraj Chaudhary. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET65206

Publish Date : 2024-11-13

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online