Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Valuation of Hotel Property in Nsukka Urban, Nigeria: Problems and Countermeasures

Authors: Obinna F. Emeafor , Emenike, Kingsley Chikwuado

DOI Link: https://doi.org/10.22214/ijraset.2024.56003

Certificate: View Certificate

Abstract

The focal objective of this study is to review valuation of hotel property in nsukka urban, Nigeria: problems and countermeasures, looking at hotel property as a hospitality and tourism facility that requires skills, concepts and technicalities that makes it physically, socially and economically attractive to customers at the same time fulfilling motive for its ownership. The study appraises hotel property and factors that militates it from commanding its proper open market value after valuation. Data were analyzed using scaling radial list analysis (SRLA), secondly, Data was processed by coding using the Statistical Package for Social Sciences (SPSS) version 23 software in determining any statistical significance. While descriptive statistics; Chi-square and Pearson r. are method used. It’s in our believe system, that our findings, conclusion and recommendation made from this research study will be a useful tool to hospitalists and tourism professional as well as estate surveyor and valuers and other related professionals in delivering their professional responsibility ensuring that cost value and quality are not compromised

Introduction

I. INTRODUCTION

Hotel is a special segment of real estate that provides paid accommodation, food, beverage, and other services, such as laundry services for guests, including tourists on a temporary basis. According to Newell and Seabrook (2006), hotel properties represent the important property investment sector that belongs to the non-residential type of real estate, and require unique management expertise. As a specialized property investment area (Durodola and Oloyede 2011), hotels demand proper valuation for their long-term survival.

Jackson (2008) defines ‘valuation’ as the systematic determination of the worth, i.e., the amount for which a property will transact on the open market at a given time. Valuation provides a quantitative measure of the benefits and liabilities accruing from the ownership of the real estate and is carried out by a number of different players (Fu, Sheel and Lang 2013). A proper understanding of the processes of valuation and the concomitant challenges is important not only for sellers and buyers of hotel businesses (Cullinan, Le Roux, & Weddigen, 2004), but also for hotel managers, who are involved in making essential resource allocation decisions (Fu, Sheel and Lang 2013). In Nsukka urban, the number of hotels has proliferated in the last few years; this is suggestive of increase in the number of visitors to the area. As more investors move into investing in hotels in the Nsukka area, there is the need to pay close attention to hotel valuation, which if properly understood and executed, can lure more hotel investors to Nsukka, and can equally discourage hotel investment where the reverse is the case. Thus, it is necessary to carry out a comprehensive study, which will among other things, identify and discuss the problems of hotel valuation in the study area, as well as proffer measures to eliminate or mitigate the identified problems. Clearly, ‘hotel valuation’ is a highly under-researched topic in not just Nsukka, but Nigeria and many parts of developing nations. Manning et al. (2015) have rightfully remarked that the real-estate aspects of hotels and hotel construction issues are still an understudied scientific area and there is a need for detailed research and observation therein. Following from the aforesaid, the specific objectives of the study include:

- To identify the best valuation technique applicable to the study area;

- To ascertain the general problems of hotel valuation in the study area; and

- To put forward countermeasures for the identified hotel valuation challenges.

Estimating fair value of a hotel property is a top priority for the sustainability of hotels. Thus, this paper contributes its quota in bringing to the fore, useful data for the promotion of hotel valuation as a management tool in the accommodation industry. The outcome of the research is also expected to serve as a source material for hotel investors, real estate valuers, policymakers, researchers and students as it uncovers the problems of valuation of hotel property in developing countries. By doing so, the paper helps to redraw the boundary of hotel valuation knowledge.

II. LITERATURE REVIEW

In the view of Selwyn (2000: 288), “hotel is a tourism business unit which, as its main endeavor, rents room accommodation to the general public for a minimum duration of one night”. In the Microsoft Encarta Dictionary (2009), ‘hotel’ is defined as “a building or commercial establishment where people pay for lodging, and where meals and other facilities such as conference rooms are often available. According to Manning; O’Neill; Singh; Hood; Liu and Bloom (2015), hotels constitute a unique investment asset class as they are an operating business, with both housing and retail activities (such as food and beverage, accommodations, health spa, banqueting facilities, and recreational amenities) ‘‘housed’’ within a real estate investment. However, it should be borne in mind that investment in hotels is not easy a task.

Popovic, Stanujkic and Karabasevic (2019) remark that investment in hotels is a high-risk investment because the return on investment depends on both the real estate market and the tourism market, which are very unpredictable and volatile. This risk, caused by the sensitivity of investment return to the changing conditions of the local and national market economies, they argued, is systematic and not easy to manage. Additionally, the performance of hospitality assets is susceptible to greater market fluctuations, location issues, management sophistication and high capital investment than other real estate classes such as office or retail (www.horwathhtl.com) The aforementioned make the valuation of hospitality assets a herculean task (see also Walsh and Staley, 1993).

Three traditional techniques are commonly used in valuing hotel properties: income capitalization, sales comparison, and the cost approach (Fu, Sheel and Lang 2013; Chen and Kim 2009, Menorca 1993). The key goal of the three valuation approaches as opined by Andrew, Damitio, and Schmidgall (2007) is to measure market value of hospitality property to secure financing and/or to determine the sale price of a property.

The first, capitalization rate (also known as cap rate), as used in the real estate literature refers to the ratio of net operating income to property value (Jud and Winkler, 1995). According to Chen and Kim (2009), income capitalization approach, requires investors and appraisers to estimate the price of a hotel property in accordance with the current value of future cash flows generated from owning and operating a hotel property. Brueggeman and Fisher (2005) are of the view that cap rate (capitalization rate) has a particularly important role in property valuation, because the income capitalization method converts the expected income stream from commercial property into an estimate of asset value by dividing the net operating income stream by the capitalization rate. Summarily, it could be said that capitalization rate shows the potential rate of return on the real estate investment; the higher the capitalization rate, the better it is for investors (The Economic Times, 2021).

In the view of Andrew, Damitio, and Schmidgall (2007), the sales comparison approach is used to consider recent hotel sales transactions to determine what the market is currently willing to pay for a specific hotel property. The authors note that the sales comparison approach relies on making adjustments to compensate for variation between unique assets. Fundamentally, sales comparison approach determines market value on the ground that hotel investors may likely not offer more for a hotel beyond what it would cost to purchase similar property in a given locality.

The third and final valuation approach is the cost approach. The cost approach is a real estate valuation method that attempts to reconcile the price a buyer should pay for a piece of property with the cost of constructing an equivalent building (Liberto, 2021). In the cost approach, the property's value is equal to the cost of land, plus total costs of construction (Libertor, 2021). Lesser (1992) avers that the cost approach addresses development and acquisition costs and generally does not consider hotel as an operating business. This is to say that the cost approach does not focus on income-related considerations; hence, it is most suitable for new facilities. Be that as it may, every valuation approach has its merits and demerits.

Majumdar (2019) in a study titled, Valuation of Hotel Property: Issues and Challenges, found that the major challenges encountered in the valuation process as highlighted by the respondents are: the growing uncertainty associated with projections of future earnings given the plethora of assumptions made at a micro and macro level, and (b) determination of an appropriate discounting factor for computing the present value of future cash flows.

In their own contribution, ?róbek and Grzesik (2013) remark that the main challenge for valuation professionals lies in developing a deeper understanding of market globalization and better analytical skills, with a view to assessing accurate values. They argue that it is no longer sufficient for valuers to simply report market value due to the diversity of applications of valuation reports.Valuers, according to ?róbek and Grzesik, should also know that contemporary clients require a more detailed analysis of past, present and future market trends, as well as a risk analysis of the property valued.

As it concerns Nigeria, Ajibola (2010) notes that one of the problems of valuation is incursions by other professionals, such as engineers, accountants, bankers, into the realm of property valuation.

The writer also raised the issue of valuation inaccuracy. Using Lagos state as a case in point, Ajibola found that valuation inaccuracy in Lagos Metropolis result from dearth of market evidence (data), use of outdated valuation approach and clients’ influence.

Abidoye and Chan (2016) sought to investigate the extent to which real estate valuers practicing in Nigeria are aware and use the advanced valuation approaches in real estate valuation practice. They found that Nigerian professionals are mostly aware of the traditional methods and always use the “sales comparison method” in practice. In contrast, they are not very aware of the advanced approaches and hence, only use the hedonic pricing model occasionally in practice. The authors concluded that the finding is a wake-up call for the real estate regulatory bodies and indeed all the real estate professionals in Nigeria to embrace the use of the advanced valuation approaches in practice, in order to remain relevant in the international real estate practice.

Using literature analysis as a research approach, Onwuanyi (2020) found that Data on Nigeria’s property sector tends to be inadequate and inaccessible. The gap in data creates a challenging situation for property valuers, since poor accessibility to property data leads valuers to enact coping mechanisms rather than best practice. They recommended the creation of a central property data bank, which offers opportunities for a solution.

Oloyede, Ayedun & Ajibola (2011) analyzed the issues facing the real estate profession in Nigeria sourcing materials from observations of earlier researchers in the conduct of estate surveying and valuation practitioners and public opinion. Result of the analysis showed that the continuous influx of intruders into real estate business is as a result of inability of those registered estate surveyors and valuers to meet the local demand for their services coupled with the poor performance of some sole proprietor firms in the area of valuation accuracy. They recommended that Estate Surveyors and Valuers Registration Board of Nigeria need to encourage partnerships and the registration of additional estate management graduates through extensive training and rigorous accreditation standards.

In their work titled ‘Developing an Efficient Database for Property Valuation in Anambra State, Nigeria’, Emoh and Onyejiaka (2020) found thatt the causes of inaccessibility to property market data are lack of organized records, lack of regular market surveys, use of traditional filing systems and non use of computer technology. Similarly, the research proved that the use of MySQL database system can indeed ensure speed and accuracy of valuation exercises and reliability of valuation figures and opinions.

The sampled empirical studies show that property valuation in Nigeria requires serious improvement, let alone a specialized real estate segment such as hotel. Little or nothing was uncovered in a search of literature on hotel property valuation in Nigeria, hence this study.

III. BACKGROUND ACCOUNT OF STUDY AREA

Nsukka is the headquarters of Nsukka Local Government Area of Enugu State, Nigeria. The town is situated on the north-western border of Enugu State; lying at “latitude 06 52IN, longitude 07 24IE and with an altitude of 447.26 metres above sea level” (Onyeonagu and Asiegbu 2006).

Nsukka main town is made up of Nkpunanor, Ihe n’ Owerre and Nru communities; each of these communities comprise smaller villages and clans. However, neighbouring towns such as Orba, Enugu-ezike, Obollo-afor, Mkplogwu, Okpuje, etc. are sometimes referred to as Nsukka because of their close affinity not only in physical terms, but also in socio-cultural relatedness. This explains why all of the mentioned towns fall under one political zone known as Nsukka or Enugu North Senatorial Zone.

In the view of Ofomata (1972), the landforms of the Nsukka area, asin most south-eastern Nigeria, are developed over relatively simple geological formations. The sedimentary formations which cover the area fall into three main but simple geological groups: the shale, the coal measures and sandstones”. Ofomata notes that four geomorphic divisions which are closely related can be identified in the Nsukka area: western lowland, a plateau zone, an escarpment zone, and eastern lowland. Nsukka has a tropical wet and dry climate; two distinct seasons - wet and dry – are recognizable. On the average, the weather condition of Nsukka is quite caressing and the vegetation is best described as derived savanna.

The population of Nsukka urban has continued to grow steadily in the last five years resulting in greater urbanization. Obviously, the proliferation of hotels is seen as one of the effects of population growth in Nsukka metropolis. With population growth, town planning officials are now saddled with greater responsibility of producing a roadmap for sustainable urbanization. Equally, there is now need for proper hotel valuation processes to encourage investors in the hospitality industry.

IV. MATERIALS AND METHOD

The study was conducted in Nsukka urban as a case study; reason being that, Nsukka urban is the heart of Nsukka megapolis due to certain features that distinguishes it from its urban counterparts this features includes population, pattern of settlement and level of economic activities. This feature has a significant impact on the outcome of this study. However, data for this research was collected from two major sources namely primary source, this consist of site visit and direct observation, administration of oral interview (transcribing it to written form) due to the nature of the study, and use of pictograph where necessary. While our secondary source of data collection includes consulting of previewed reputable journals, newsletters, magazine, text books, conference proceedings and related websites. 20 hotels where randomly picked via simple random for the study, from the study area hence our interaction was made with 20 hotel managers and few customers that patronizes the hotels. Data were analyzed using scaling radial list analysis (SRLA), secondly, Data was processed by coding using the Statistical Package for Social Sciences (SPSS) version 23 software in determining any statistical significance. While descriptive statistics; Chi-square and Pearson r. are method used. Data analysis is presented and discussed in details in the section below pointing out significant components

V. FINDINGS BASED ON SITE VISIT

The administration of questionnaire to hotels was a big challenge base on the nature of the study, we personally went to various hotels collected data orally and transcribed it formally in writing, direct observation was another advantage that helped us get fact as some hotel manager will not be open enough in providing certain data for the purpose of image preservation. Twenty hotels were randomly selected for the purpose of this study; data were analyzed using the Statistical package for social science (SPSS) software version 23. Below were our physical observation made upon site visit and investigation.

The study found out the following shortcoming;

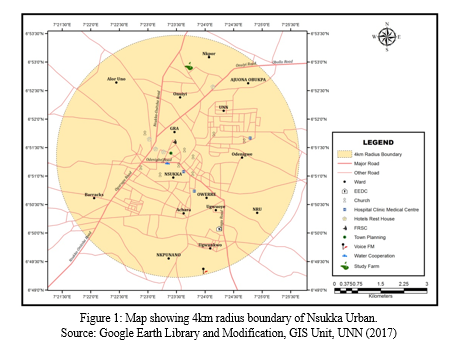

1) Hotel is a hospitality and tourism property this requires a well-planned, pleasant and aesthetically designed environment (state of art) that will attract visitors and personalities that patronizes such facilities at a maximum utility. However reverse was the case in some of the hotels we visited figure 5.1 shows the entrance of a hotel with dilapidated entrance gate, poorly furnished compound.

VI. DISCUSSION

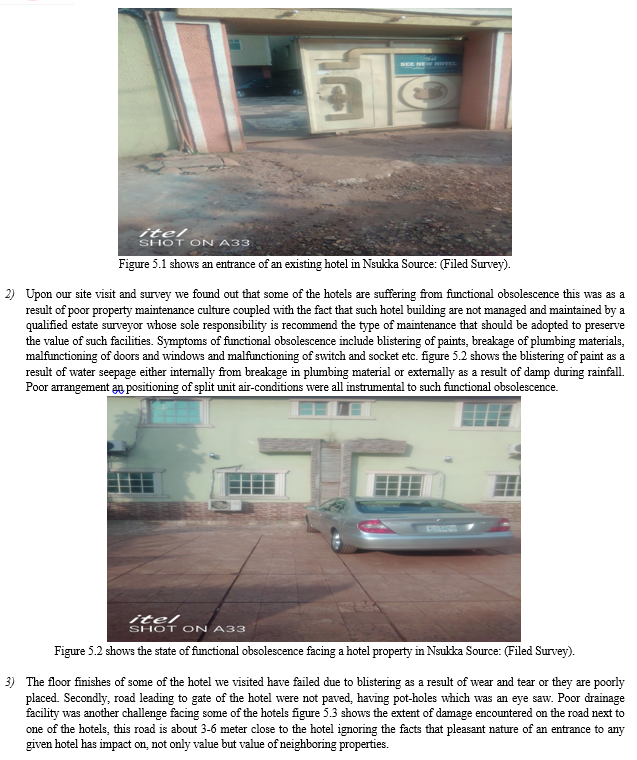

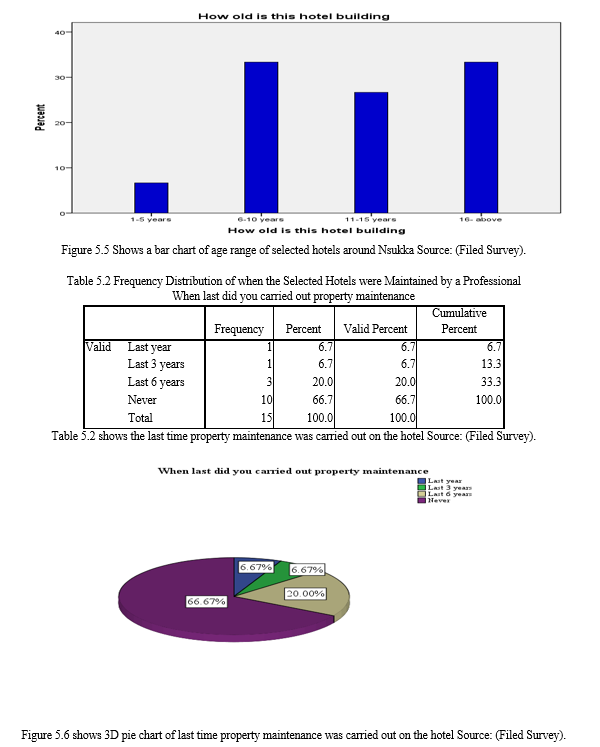

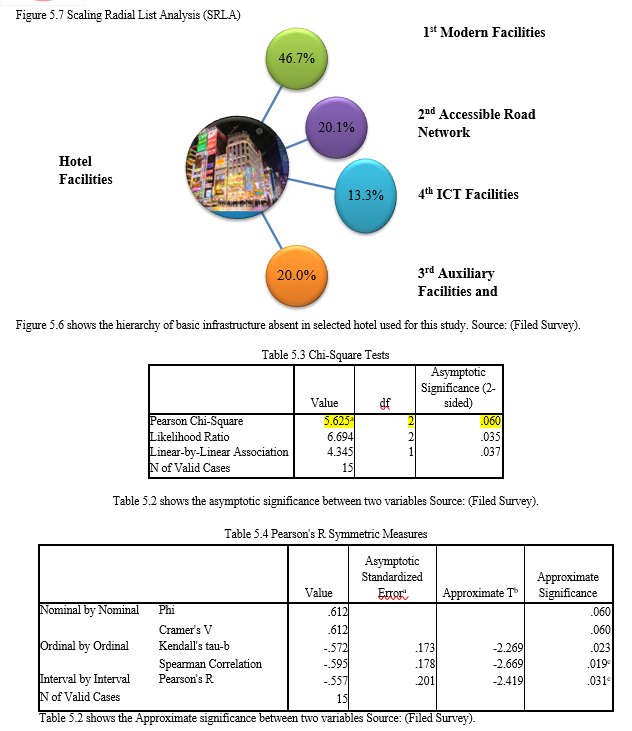

From the findings above, the study observed that, the process and procedure hotel property are being presently managed itself poses a danger to the success of the hotel since management maintenance and sustainability must start from the infant stage of the said hotel property. Table 5.1 and figure 5.5 elucidates that most of the hotel are built between five year ago and few recently built. However, lack of well-structured property maintenance was found to be one of the reasons they suddenly depreciate in real value which also affect its open market value during property valuation. Secondly, table 5.2 and figure 5.6 shows that majority of the hotel in the study area has never for once under gone property maintenance. Figure 5.7 pointed out basic infrastructure that are absent in most of the hotels that needs to be present, this were found to be factors that militate the level of value a hotel should command during valuation. Thirdly, the study reveals that most hotels lack facilities like conference halls, ICT, recreation and utility facilities while other hotel have no other service to render other than lodging accommodation and pub in which table 5.3 shows that the impact of not having such facilities has no significant relation with 0.60 ≥ 0.50. However, the impact should not be overlooked. Finally, the outcome of this study reveals that valuation and transaction of hotel property are scarce reason, being that an investor will prefer a real estate investment that promises higher and faster returns than the real investment with slower returns. We also discovered that customers usually patronizes the old hotels during festivals and academic event due to high population during events and factors of demand and supply this also have significance correlation r = 0.60 ≥ 0.50. Furthermore, the role of hospitality and tourism plays a pivotal role in adding to the value of the hotel having in mind that hotel is a building, but the service and environment created in the building brings out the desired hospitality and comforts. This was also found to be amongst the factor affecting hotel valuation in the study area.

Conclusion

This study has x-rayed some factors that affect valuation of hotel properties in Nsukka urban, looking at the nature of hotel property; the sole aim of providing a hotel structure is to provide customers with hospitality and comfort for a fee. We therefore recommend that both hospitalists professionals, real estate surveyors and valuers and professionals concerned need to partner so as to foster ideology, concepts and technicality that will enhance property value during valuation and at the same time offer attraction that will always be appealing to customers. This can be achieved through planned periodic maintenance and renovation, adapting to trends and modification where necessary, application of contemporary skills that are cost effective, environmentally friendly and socially aesthetic hence a sustainable hotel management practice. this will not only enhance hotel property valuation, it will promote professionalism among stakeholders concerned, create wealth and job opportunity in the study area and impact positively on health and wellbeing of customers in which the outcome will always create a walk to remember in the hospitality and tourism sector as well as enhance valuation output in the real estate management and valuation sector.

References

[1] Abidoye, R.B. and Chan, A.P.C. (2016), \\\"A survey of property valuation approaches in Nigeria\\\", Property Management, Vol. 34 No. 5, pp. 364-380. https://doi.org/10.1108/PM-07-2015-0035 [2] Ajibola, M. O. (2010). Valuation Inaccuracy: An Examination of Causes in Lagos Metropolis. Journal of Sustainable Development Vol. 3, No. 4; Decmber 2010 [3] Andrew, W.P., J. Damitio, and R.S. Schmidgall. Financial Management for the Hospitality Industry. First edition. Upper Saddle, NJ: Prentice-Hall, 2007. [4] Brueggeman, W.B. and J.D. Fisher. Real Estate Finance and Investments. 12th edition. New York, NY: McGraw-Hill Irwin, 2005. [5] Chen, M.S. and Kim, W.G. Hotel Valuation in China: A Case Study of a State-Owned Hotel. Cornell Hospitality Quarterly, June 17, 2009, Volume XX, Issue X. [6] Cullinan, G., Le Roux, J., & Weddigen, R. (2004). When to walk away from a deal. Harvard Business Review, 82(4), 96–104. [7] Durodola, O.D. and Oloyede, S.A. Impact of Property Assets’ Management Styles on Effective Service Delivery in South-Western Nigerian Hotels. Journal of Sustainable Development Vol. 4, No. 4; August 2011. [8] Emoh, F.I. and Onyejiaka, J.C. Developing an Efficient Database for Property Valuation in Anambra State, Nigeria. British Journal of Environmental Sciences Vol.8, No.2, pp. 18-56, July 2020 [9] Fu, J.; Sheel, A. and Lang, J. A Re-examination of Current Hotel Valuation Techniques – Which Approach is more Realistic? The Journal of Hospitality Financial Management, 21:17–30, 2013. [10] Popovic, G., Stanujkic, D. & Karabasevic, D. A Framework for the Evaluation of Hotel Property Development Projects. International Journal of Strategic Property Management, Vol. 23 Issue 2: 96–107, 2019. Horwath HTL employs - www.horwathhtl.com [11] Jud, G. D. and D. T. Winkler. \\\"The Capitalization Rate of Commercial Properties and Market Returns,\\\" Journal of Real Estate Research, vol. 10, no. 5, 1995, pp. 509-518. [12] Lesser, D. H. (1992) ‘Property-tax valuation of lodging property’, Cornell Hotel and Restaurant Administration Quarterly, Vol. 33, No. 1, pp. 73–81. [13] Liberto, D. (2021). What is the Cost Approach? Retrieved December 4, 2020 from https://www.investopedia.com/terms/c/cost-approach.asp [14] Majumdar, R. (2019), \\\"Valuation of hotel property: issues and challenges\\\", Worldwide Hospitality and Tourism Themes, Vol. 11 No. 4, pp. 418-428. https://doi.org/10.1108/WHATT-04-2019-0017 [15] Manning, C.; O’Neill, J.W.; Singh, A.J.; Hood, S.; Liu, C. and Bloom, B.A.N. The Emergence of Hotel/Lodging Real Estate Researcher. Journal of Real Estate Literature, Vol. 23, No.1, 2015 [16] Menorca, E.S. (1993), \\\"Hotel Valuations: the Income Capitalization Approach\\\". Journal of Property Valuation and Investment, Vol. 11, No. 3, Pp. 211-216. https://doi.org/10.1108/14635789310027301 Microsoft Encarta Dictionary (2009) [17] Newell, G., & Seabrook, R. (2006). Factors influencing hotel investment decision making. Journal of Property Investment & Finance, 24(4), 279-294. [18] Oloyede, S.A.; Ayedun, C.A. & Ajibola, M.O. Issues facing the Estate Surveying and Valuation Profession in Nigeria. Business Management Dynamics Vol.1, No.2, August 2011, pp.54-60. [19] Onwuanyi, N. (2020). A Review of the Property Data Challenge in Nigeria. Journal of African Real Estate Research, 5(2), pp.15-40. DOI: 10.15641/jarer.v5i2.842. [20] Rushmore (1992), ref. 1 above; Bodlender, J. (1985) ‘Going concern valuations for the hotel industry’, Journal of Valuation, Vol. 3, No. 2, pp. 134–144; Novelli, N. A. and Procter, A. (1992) ‘Real estate valuation: A transatlantic perspective’, Appraisal Journal, Vol. 60, No. 2, pp. 247–256. [21] Selwyn, T. (2000). Hotel. In Jafari, J. (Ed.). 2000, Encyclopedia of Tourism. London: Routledge. p. 288. [22] The Economic Times (2021). Definition of Capitalization Rate. Retrieved, December 4, 2021 from https://economictimes.indiatimes. com/definition/capitalization-rate [23] ?róbek S., Grzesik C., (2013), “Modern challenges facing the valuation profession and allied university education in Poland”, Real Estate Management and Valuation, vol. 21, no 1, pp. 14-18.

Copyright

Copyright © 2024 Obinna F. Emeafor , Emenike, Kingsley Chikwuado. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET56003

Publish Date : 2023-10-04

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online